HELP & TUTORIAL

Upturn: Empowering Your Investment Journey

Learn in-depth about each of the terms

Your Investment Journey in 3 Steps

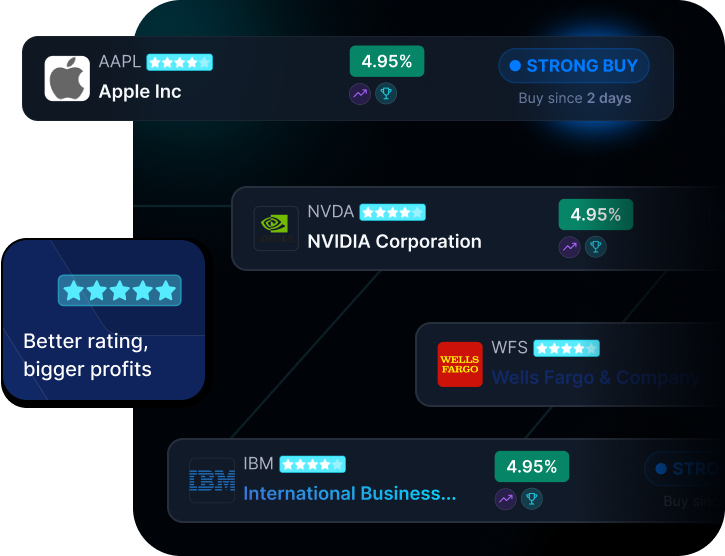

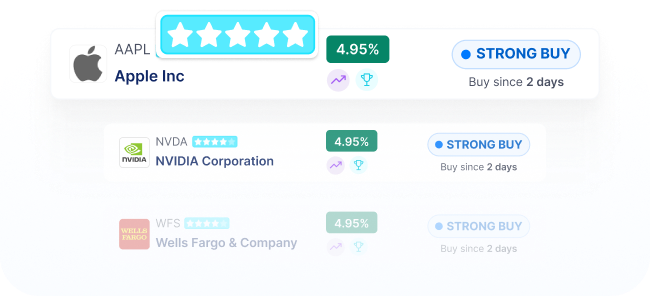

Choose stocks/ETFs with Upturn Star Rating of 4+ stars. Our AI evaluates performance, trends, and market conditions to identify winners.

Focus on "Strong Buy" advisories to catch upward trends. Our system tracks momentum and timing to maximize your entry points.

Hold 12-18 stocks/ETFs to mitigate risk. We help you build a balanced portfolio across ratings and market caps.

Your Investment Journey in

3 Steps

FEATURES

How everyday investors leverage Upturn

Upturn Advisories is built around a powerful and uncommon principle in the investment world: bold transparency. At its core, Upturn is committed to showcasing not just what it recommends, but how those recommendations have actually performed-offering more than two years of historical BUY and SELL advisories for every stock and ETF it tracks. While many platforms provide star ratings and generic signals, Upturn stands out by making its full recommendation history openly available, enabling investors to evaluate its accuracy and consistency over time and make confident, de-risked decisions.

Upturn leverages advanced AI and proprietary statistical models to generate daily investment advisories for over 9,000 NASDAQ and NYSE-listed US stocks and ETFs. While individual advisories are consistent across users, everyday investors can personalize their experience by applying filters-such as Upturn Star Rating, market cap (large-cap or mid-cap), security type (stock or ETF), stock price range, and current advisory status and by creating custom watchlists or Upturn-assisted Robo-Portfolios aligned with their individual risk tolerance and financial goals.

Each stock or ETF is assigned an Upturn Star Rating, reflecting the investment potential of stocks and ETFs based solely on their historical performance against Upturn Advisories -giving users a quick, data-backed way to assess potential.

To further enrich investment decisions, Upturn provides AI-summarized SWOT-style analyses for each asset. These concise, strategic summaries offer a well-rounded view of strengths, market share, opportunities, financial performance, competition, growth projections, risks, and key trends-insights typically reserved for institutional investors.

What truly sets Upturn apart is this: It doesn’t just tell you what to buy-it shows you how its recommendations have performed.

With this “Boldly Transparent” foundation, Upturn empowers investors to:

- Review and trust the platform’s advisory track record.

- Identify patterns in market movements and sector strength.

- Gain long-term confidence in portfolio construction.

Additional highlights of the platform include:

- Robo-Portfolios: Build diversified, AI-guided portfolios with Upturn’s assistance.

- Retail-First Experience: Intuitively designed for both novice and experienced investors.

- Retail-Ready Intelligence: Visual dashboards, market indicators, and curated portfolios translate complex data into simple decisions.

- Accessible & Affordable: Delivers advisor-level insights at a fraction of the cost, built specifically for the everyday investor.

In a landscape cluttered with opaque advice and one-size-fits-all platforms, Upturn gives retail investors the tools, transparency, and intelligence they need to invest smarter-with clarity and confidence.

Key Benefits of Upturn Advisory for the Everyday Investor

Upturn Advisory is designed to help everyday investors cut through the noise, spot stronger opportunities, and make confident decisions with clear, AI-powered insights.

Spot Opportunities Instantly with AI-Powered Daily Advisories Get clear, automated BUY, SELL, or PASS signals on over 9,000 U.S. stocks and ETFs, so you save time and never miss a potential mover - even if you’re not tracking the market every day.

Build Confidence with a Boldly Transparent History See 2+ years of real historical advisories, helping you check how past signals performed so you can trust today’s calls and make more informed decisions.

Focus on High-Quality Stocks with Upturn Star Ratings Each stock and ETF is given a 1–5 star rating, so you can instantly spot stronger, historically better-performing picks and narrow down thousands of options.

Save Time with Top Picks & Top Performers Explore curated lists of today’s strongest movers and long-term outperformers, so you can discover momentum stocks quickly without hours of manual research.

Diversify Smartly with Robo-Portfolios Create instant or custom portfolios tested through 500+ simulations and scored for risk and return, helping you build a balanced mix that fits your goals - even if you’re new to investing.

Understand Stocks Faster with AI-Summarized SWOT Analysis Read simple, strategic SWOT-style snapshots of each stock’s Strengths, Weaknesses, Opportunities, and Threats, so you grasp key factors in seconds without needing deep research.

Find the Right Picks with Advanced Search & Filters Search by ticker, sector, or theme, then filter by star rating, advisory signal, market cap, and more, so you can easily zero in on stocks that match your strategy and risk comfort.

Stay Ahead with Market Insight Tools Use visual tools like the Upturn Gauge, which tracks BUY vs SELL trends so you can spot bullish or bearish phases and adjust your plan with clarity.

Following sections go into details of these features

Upturn Buy or Sell Advisories

Get daily updated Upturn BUY/SELL recommendations for stocks and ETFs, empowering confident investment decisions.

Upturn Star Ratings for Stocks/ETFs

Upturn's star ratings assist investors in identifying top-performing U.S. stocks and ETFs. Higher ratings reflect stronger historical performance based on Upturn's proprietary analysis.

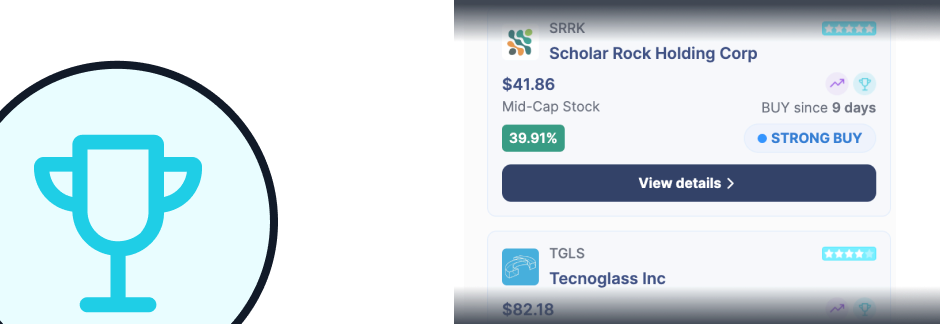

Discover Today's Top Picks

Identify the best-performing stocks of the day, curated by our advanced analysis tools.

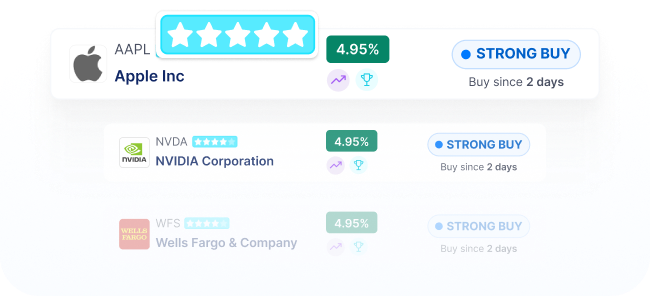

Today's Top Picks highlights stocks with an Upturn Star Rating of 4 or higher, a Strong BUY advisory issued within the last three weeks, classified as Large-Cap or Mid-Cap with at least 500 full-time employees, and showing positive recent profits with a trading volume of at least one million shares.

Discover Top Performers

Track the top-performing US stocks in the market to stay ahead of investment trends.

Upturn's Top Performers showcases large-cap and mid-cap Stocks and ETFs with an Upturn Star Rating of 4 or higher. These selections have demonstrated exceptional returns based on Upturn's BUY and SELL advisories over the past five quarters, as determined through simulations.

Market Insights Based on Upturn Advisories

Leverage Upturn's market-wide advisory trend to anticipate movements and seize opportunities.

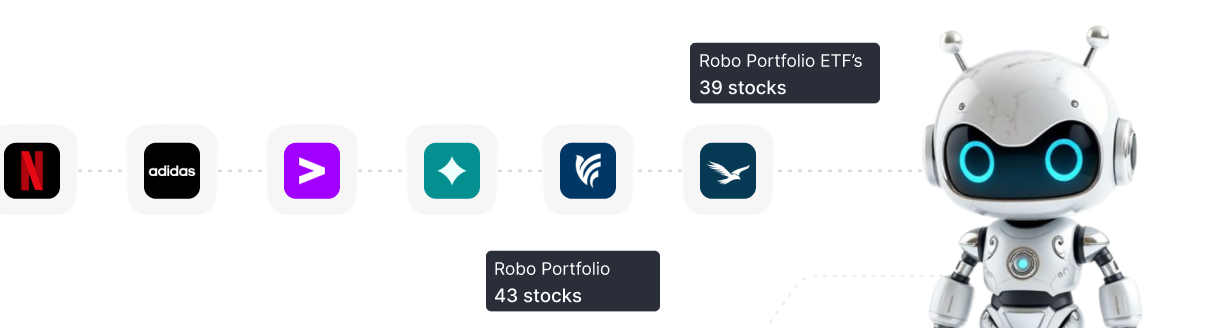

Create Robo-Portfolios Bots

Create diversified, AI-driven portfolios tailored to your investment goals, and receive daily notifications when a stock or ETF becomes a BUY or a SELL.

RESEARCH TOOLS

Holistic Evaluation of Corporate Financials, Strategic Initiatives, and Market Influences

Research on Company’s Fundamentals

Click on "View Details" for the stock/ETF to explore these metrics

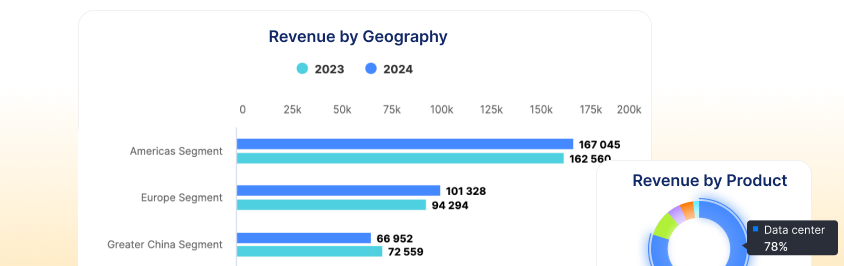

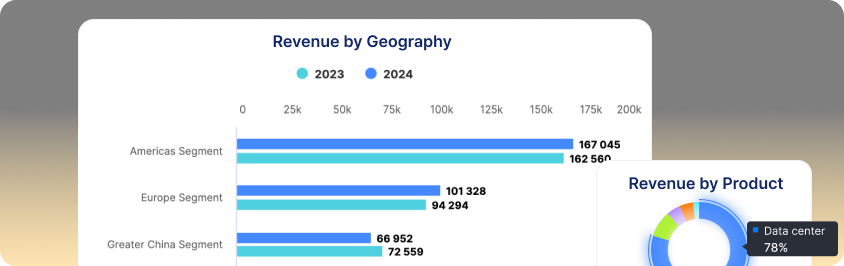

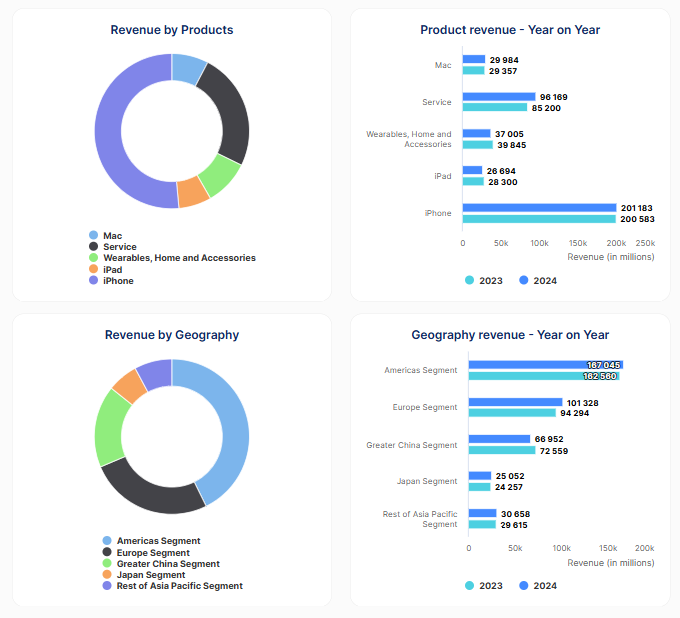

Analyzing Revenue: Products, Geography, and Growth

These charts, offer a visual comparison of revenue across product and geographic segments over a two-year period, showing both segment size and growth.

Click on "View Details" for the stock/ETF to explore these charts.

Upturn AI SWOT: Clear, Actionable Stock Analysis

A SWOT-like analysis providing a holistic view of

- Strengths

- Market share

- Opportunities (tailwinds)

- Financial performance

- Competition

- Growth projections

- Challenges (headwinds)

- Key trends

The AI-derived fundamentals rating offers a concise summary of key insights, enhanced by dynamic visualizations, to support informed investment decisions.

Upturn Advisories

Enhance Your Investment Strategy with Upturn's Additional Features

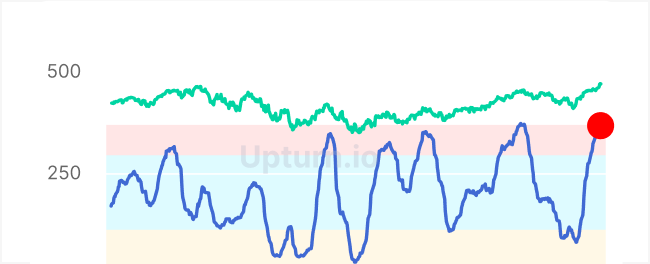

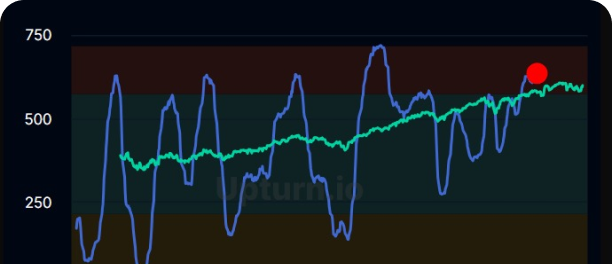

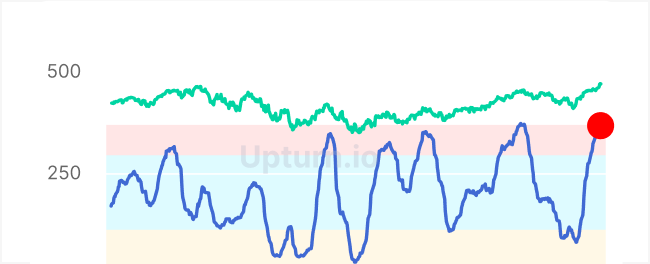

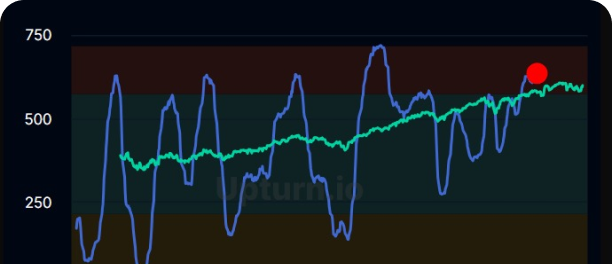

Upturn Gauge: The Pulse of Bulls and Bears

Analyzing the distribution of BUY and SELL advisories among stocks which are Large-cap or Mid-cap and rated Upturn 3 Star or higher reveals overarching trends in the U.S. stock market. This analysis helps identify whether the market sentiment is bullish, bearish, or anticipating a correction.

The Upturn Advisories graph features color-coded sections-yellow, blue, and red-that help investors quickly assess market conditions, indicating periods of recession, growth, or potential correction. This graph is overlaid on the S&P 500 price chart, offering a clear view of the U.S. market's performance.

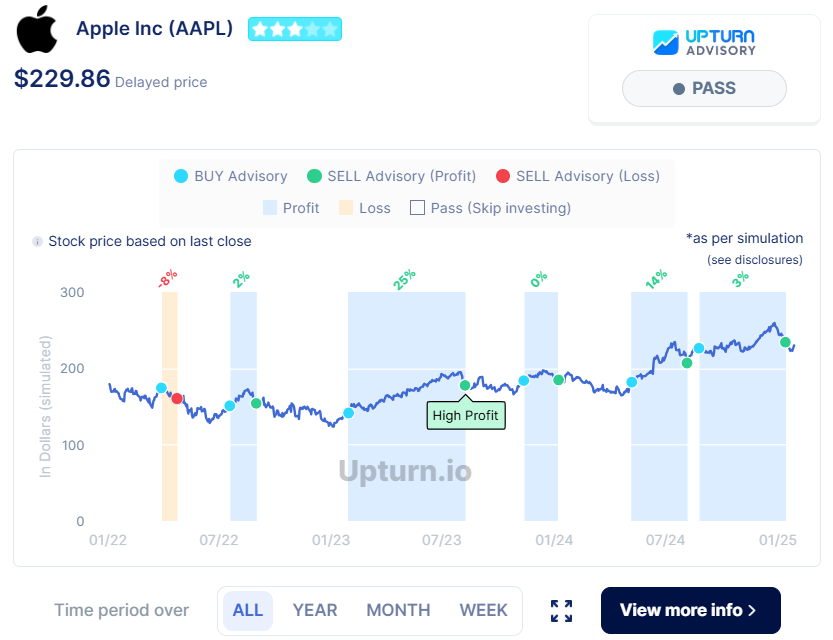

Understanding Upturn's Stock/ETF Advisory Chart

This chart gives a clear, visual overview of Upturn's past BUY and SELL advisories for Apple (AAPL) used as an example, helping everyday investors see how those calls performed and what the current recommendation is.

Key Elements of the Chart

- Stock Price: The price shown ($229.86) is delayed by 24 hours, reflecting the last market close (usually from the previous trading day).

- Upturn Star Rating: Apple’s 3-star Upturn Star Rating indicates that, based on Upturn’s advisory, the stock has historically performed in line with the broader market-delivering stable but modest returns. However, past performance is not indicative of future results.

- Current Advisory: PASS: “PASS” means Upturn does not recommend buying or holding Apple stock at this time.

- Other possible advisories include:

- STRONG BUY / BUY / WEAK BUY – graded confidence in buying

- SELL – indicates it's time to exit if you're holding the stock

- BUY & SELL Dots Explained

- Blue Dots = BUY Signals - When Upturn previously advised buying.

- Green Dots = SELL with Profit - Selling would have earned a gain.

- Red Dots = SELL with Loss - Selling would have resulted in a loss.

- 📊 Profit & Loss Bars

- Blue Bars = Profit - When the simulated trade made money.

- Orange Bars = Loss - When the simulated trade would’ve lost money.

- The percentage above each bar shows how much the simulated trade gained or lost.

- 📅 Time Range & Trend Analysis

- The chart shows how Apple’s price has moved over time, with simulated trades overlayed.

- You can switch between ALL, YEAR, MONTH, or WEEK views to spot short- or long-term patterns.

- This helps identify trends, market cycles, and the timing of past recommendations.

Investors are advised to consult the Disclosures section for details on the assumptions made in these simulations. While the simulations aim for directional accuracy, actual returns may vary due to market conditions and execution factors.

What Do Upturn Advisories Mean?

BUY Advisory (Strong / Regular / Weak)

A BUY advisory means the stock or ETF appears to be trending upward, based on Upturn’s AI/ML and quantitative analysis. There are three levels:

- STRONG BUY

Many strong signals point to an uptrend.

This is a good time to buy the stock or ETF if you are considering an entry. - REGULAR BUY

Moderate signals suggest a likely uptrend.

One might want to wait until it turns into a Strong Buy, but it could still be okay to buy-especially if the BUY advisory is recent (e.g., within the last 20 days). - WEAK BUY

A few mild signals indicate a possible uptrend, but the trend is weak.

This may not be a good time to buy. The advisory could shift to SELL anytime.

Note: If the stock or ETF has a 1- or 2-star rating, even with a BUY signal, Upturn will show: "Consider higher Upturn Star rating" for better historical performance.

- PASS Advisory

A PASS means there’s no strong uptrend at the moment.

It’s best to skip this stock or ETF for now and wait for clearer signals. - SELL Advisory

A SELL advisory appears when growth signals fade and no further upward momentum is expected.

This is a signal to exit the position if you’re already holding it.

Upturn Star Rating for Stocks and ETFs

The Upturn Star Rating reflects the investment potential of stocks and ETFs based solely on their historical performance against Upturn Advisories. It does not currently factor in company or ETF fundamentals. The Upturn Star Rating is derived from a combination of the following factors:

- Upturn Advisory Performance: Evaluates the historical success rate of Upturn's AI-driven BUY/SELL advisories, indicating how often these recommendations have led to profitable outcomes.

- Stock Returns Performance: Measures the cumulative returns achieved from following Upturn's advisories, based on simulated trading scenarios.

- Recent Stock Behavior: Considers the stock's recent performance trends to provide a timely assessment of its current investment appeal.

By integrating these elements, the Upturn Star Rating offers a comprehensive view of a stock or ETF's performance and potential.

Making the Most of Upturn Star Ratings

The Upturn Star Rating can help investors make smarter, data-backed decisions:

- Focus on High Performers: Prioritize stocks and ETFs rated 4 stars or above to target historically strong investments.

- Avoid Underperformers: Improve portfolio quality by excluding 1- and 2-star rated assets with weaker performance histories.

- Discover New Opportunities: Uncover high-potential stocks and ETFs that may have been overlooked, guided by their strong Upturn ratings.

- Build Smarter Portfolios: Create diversified Robo-portfolios using a balanced mix of top-rated stocks and ETFs aligned with your goals and risk appetite.

Integrating the Upturn Star Rating into your investment process supports more informed, confident, and goal-oriented decision-making.

Analyzing Revenue: Products, Geography and Growth

Charts showcasing revenue by product segments and geographic regions, along with year-on-year growth, is provided for every stock, provides the user several key things:

- Revenue Diversification and Concentration (Product & Geography):

- Product Portfolio Analysis: It reveals the company's revenue streams and the relative importance of each product segment. Users can quickly understand if a company's revenue is heavily reliant on a single product or if it has a diversified portfolio.

- Geographic Revenue Analysis: It also shows the distribution of revenue across different geographic regions, indicating the company's reliance on specific markets.

- Revenue Concentration Risk: It highlights potential risks associated with over-reliance on a single product segment or geographic market. If one segment or region underperforms, the company's overall revenue could be significantly impacted.

- Growth Trends (Product & Geography):

- Year-on-Year Performance: It provides a clear picture of how each product segment and geographic region's revenue has changed over time. Users can assess growth rates and identify trends.

- Growth Potential: It helps users evaluate the growth potential of different product segments and geographic markets, identifying areas where the company is experiencing strong growth or decline.

- Business Focus and Strategy (Product & Geography):

- Strategic Priorities: It reveals the company's strategic focus and priorities, both in terms of product development and market expansion. Users can see which segments and regions are generating the most revenue and likely receiving the most investment.

- Business Model Insight: It provides insights into the company's business model and its geographic footprint, showing how it generates revenue across different markets.

- Comparative Analysis:

- Benchmarking: Users can compare the revenue performance of different companies within the same industry, both in terms of product segments and geographic reach.

- Investment Decisions: This information helps users make informed investment decisions by understanding the revenue dynamics of each company, considering both product and geographic diversification and growth.

In essence, it gives the user comprehensive insight into the revenue health and business strategy of a company, considering both product and geographic dimensions, and allows them to perform detailed comparative analysis.

Watchlist, Robo-Portfolios and ETF Zone

Upturn.io's dashboard offers a suite of curated tools designed to enhance your investment experience.

The Watchlist feature allows you to monitor your preferred stocks and ETFs, providing real-time advisories and performance updates.

With Robo-Portfolios, you can create and manage personalized collections of stocks and ETFs, either through automated sampling or by selecting assets that align with your specific interests and risk criteria or any other filters. This enables you to evaluate portfolio performance and receive timely notifications on advisory changes.

Additionally, the ETF Zone showcases all Upturn 3+ Star Rated ETFs, assisting you in identifying top-rated exchange-traded funds for potential investment opportunities.

Instant and Custom Robo Portfolios

Upturn.io empowers investors with Robo-Portfolios, enabling seamless stock and ETF discovery through AI-driven portfolio creation.

With Instant Robo-Portfolios, users can generate optimized portfolios in seconds (usually less than a minute) based on their custom filters, leveraging Upturn’s advanced simulations.

Behind the scenes, for Instant robo-portfolios, Upturn enhances portfolio creation by generating 500 simulated portfolios, each comprising randomly selected stocks/ ETFs based on user-defined filters. The platform then identifies the portfolio with the strongest historical performance and highest Sharpe Ratio. This random selection process ensures that, given a sufficiently diverse pool of stocks and ETFs curated through the filter, each simulation yields a unique portfolio, even when applying the same filters.

For a more tailored approach, Custom Robo-Portfolios allow users to define filters, handpick stocks or ETFs, and track their investments effortlessly.

Every Robo-Portfolio on Upturn is assigned an Upturn Star Rating, reflecting its historical cumulative returns and Sharpe ratios based on investments made following Upturn's advisories. This rating provides investors with a clear understanding of the portfolio's past performance and risk-adjusted returns.

With Robo-Portfolios, investors can experiment with multiple strategies, refine their holdings, and compare their portfolio's performance against the SPY index, utilizing Upturn's advisories. The platform offers feedback on portfolio composition, such as diversification levels (e.g., holding fewer than 12 stocks may indicate less diversification) and the inclusion of higher-rated Upturn stocks. Additionally, it displays current BUY and SELL advisories for each asset within the Robo-Portfolio, enabling data-backed investment decisions with confidence.

Robo-Portfolios Vis-à-Vis Robo-Advisors

Upturn Robo-Portfolios give you the power of a robo-advisor, with the flexibility of a DIY strategy-and none of the guesswork. With transparent performance metrics, daily signals, and customizable filters, it’s like building a portfolio with a research team by your side. If you're ready to take charge of your investing without flying blind, Upturn might just be your smarter, data-driven alternative to traditional robo-advisors.

Upturn vs. Robo-Advisors: A Side-by-Side Comparison

| Feature | Upturn Robo-Portfolios | Traditional Robo-Advisors |

|---|---|---|

| Asset Selection | Stocks & ETFs | Primarily ETFs |

| Portfolio Control | No asset managed by Upturn. Upturn is Advisory only. Portfolio is Fully customizable by user and is DIY (do it yourself) | Automated based on risk profile |

| AI Signals | Daily BUY/SELL/PASS signals | None |

| Backtesting | Yes, with 2-year performance simulation | Rare or hidden |

| Transparency | Full visibility into rating logic and performance | Often black-box algorithms |

| Risk Adjustment | Sharpe ratio + advisory signal quality | Risk profile allocation only |

| Thematic Filtering | Yes (e.g., large-cap tech, top performers) | No |

| Rebalancing | Manual or DIY via alerts | Automatic |

| Learning Opportunity | High – educates users on how individual picks perform | Low – set it and forget it |

| Cost | Very low, designed for everyday investor | Typically 0.25–0.50% AUM annually |

Robo-Portfolio Construction Guidelines

A minimum of 12 stocks is recommended per Robo-Portfolio (especially if all are stocks) to promote diversification.

Upturn does not enforce sector or market diversification-stock selection is guided by user-defined filters such as:

- Upturn Star Rating

- Market Capitalization (e.g., large-cap or mid-cap or small-cap)

- Security Type (stock or ETF)

- Stock Price Range

- Current Advisory Status (e.g., Strong Buy, Buy, Pass)

The stocks and ETFs are chosen from the pool that matches the selected filters-either randomly, in full, or selectively based on additional user preferences, such as deeper research into specific companies.

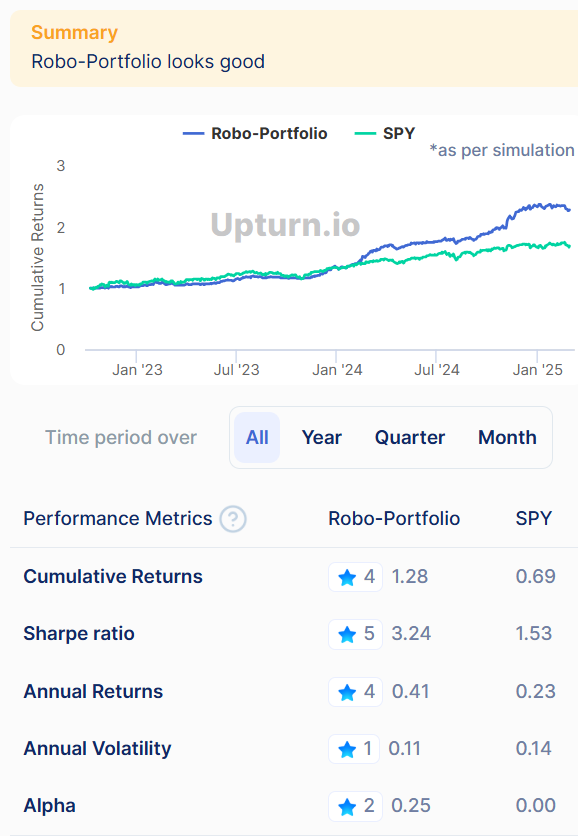

Robo Portfolio Performance Metrics

Each Robo Portfolio includes a Comprehensive performance metrics, including cumulative returns benchmarked against the S&P 500, Sharpe Ratio, annual returns, and volatility, offer deep insights into portfolio effectiveness.

Robo-Portfolios on Upturn.io are evaluated using multiple key metrics to help investors make informed decisions.

The Summary provides a high-level overview, including factors such as the number of stocks in the portfolio and the presence of higher-rated Upturn stocks.

To illustrate potential gains, Upturn.io simulates a hypothetical investment of $1.0 in an equal-weighted Robo-Portfolio, tracking performance based on Upturn’s BUY and SELL advisories. This is then compared to the same investment in SPY, providing a tangible measure of portfolio strength.

Beyond cumulative returns, additional portfolio performance metrics include the Sharpe Ratio, Annual Returns, Annual Volatility, and more.

Users can access detailed explanations of these metrics by clicking the help button next to Performance Metrics or in the Description of terms below.

Upturn Star Rating for Robo-Portfolios

The Upturn Star Rating for Robo-Portfolios indicates the overall investment potential based on historical advisory performance of a portfolio, based on a hypothetical investment strategy that follows Upturn’s BUY and SELL advisories. The rating is derived from the collective performance of the individual stocks or ETFs in the portfolio over a selected time period-past two years, one year, one quarter, or one month-as captured in the Robo Portfolio Performance metrics. It combines both cumulative returns and risk-adjusted performance to offer a comprehensive view of portfolio quality.

How Upturn Calculates Star Ratings for Robo-Portfolios

- Cumulative return: Measures how well the portfolio would have performed if an investor had followed Upturn’s historical advisories in the given time.

- Sharpe ratio: Captures the risk-adjusted return-measures how much return a portfolio generates relative to the amount of risk taken, helping assess the quality of returns after accounting for volatility.

Understanding Robo-Portfolio Star Ratings

The Robo-Portfolio Star Rating is calculated on a portfolio simulation which is over the past two years. Portfolios are then rated from 5 stars to 1 star based on the thresholds below:

![]()

![]() 5 Stars (Outstanding) Robo-Portfolios with a cumulative return of 2.0 or higher and a Sharpe ratio of at least 1.75. These portfolios have shown strong historical returns combined with efficient risk-adjusted performance.

5 Stars (Outstanding) Robo-Portfolios with a cumulative return of 2.0 or higher and a Sharpe ratio of at least 1.75. These portfolios have shown strong historical returns combined with efficient risk-adjusted performance.

![]()

![]() 4 Star Rating (Above Average) Robo-Portfolios with a cumulative return of at least 1.5 and a Sharpe ratio of 1.5 or more. These have demonstrated solid historical outcomes with favorable risk-return characteristics.

4 Star Rating (Above Average) Robo-Portfolios with a cumulative return of at least 1.5 and a Sharpe ratio of 1.5 or more. These have demonstrated solid historical outcomes with favorable risk-return characteristics.

![]()

![]() 3 Star Rating (Moderate) Robo-Portfolios with a cumulative return of at least 1.0 and a Sharpe ratio of 1.0 or greater. These generally align with market-level returns and offer balanced risk-adjusted results.

3 Star Rating (Moderate) Robo-Portfolios with a cumulative return of at least 1.0 and a Sharpe ratio of 1.0 or greater. These generally align with market-level returns and offer balanced risk-adjusted results.

![]()

![]() 2 Star Rating (Below Average) Robo-Portfolios with a cumulative return of at least 0.75 and a Sharpe ratio of 0.75 or higher. These show weaker historical performance and less efficient use of risk.

2 Star Rating (Below Average) Robo-Portfolios with a cumulative return of at least 0.75 and a Sharpe ratio of 0.75 or higher. These show weaker historical performance and less efficient use of risk.

![]()

![]() 1 Star Rating (Not Recommended) Robo-Portfolios that do not meet the minimum thresholds. They have lower cumulative returns and subpar risk-adjusted performance based on historical advisory data.

1 Star Rating (Not Recommended) Robo-Portfolios that do not meet the minimum thresholds. They have lower cumulative returns and subpar risk-adjusted performance based on historical advisory data.

⚠️ Important Note

Upturn Star Ratings for stocks and ETFs, or Robo-Portfolios reflect overall investment potential based on historical performance and, for Robo-Portfolios, favorable risk-adjusted returns. However, a higher rating does not guarantee higher future returns, and a lower rating does not imply poor future performance. Past results show the potential but are not a guarantee of future outcomes.

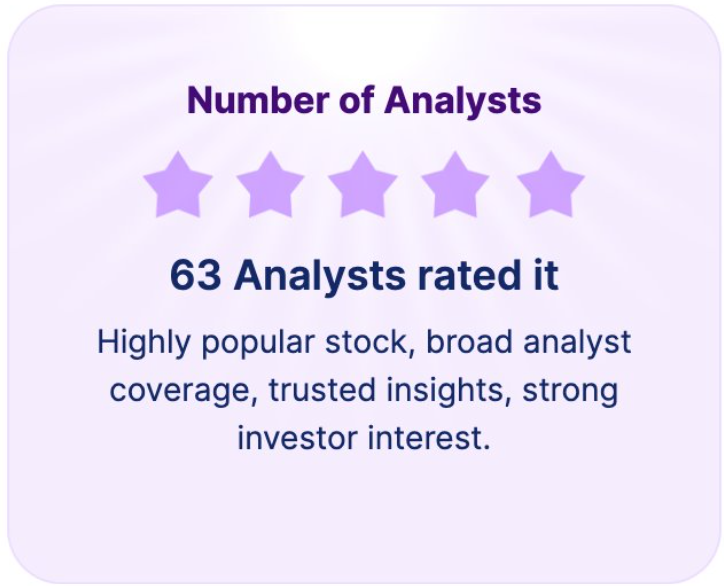

Upturn’s Analyst Coverage Star Rating

Helps investors understand how widely a stock is tracked by market analysts. The system uses a simple 1– 5 star scale based on the total number of analysts following the stock: more coverage generally means more reliable information and stronger institutional visibility.

Each star rating level includes both the analyst count and what it means for you:

![]() (5 Stars) 30 or more analysts: Highly popular stock with broad coverage, trusted insights, and strong investor interest.

(5 Stars) 30 or more analysts: Highly popular stock with broad coverage, trusted insights, and strong investor interest.

![]() (4 Stars) 20–29 analysts: Well-followed company with solid analyst reports and reliable data for confident investing.

(4 Stars) 20–29 analysts: Well-followed company with solid analyst reports and reliable data for confident investing.

![]() (3 Stars) 10–19 analysts: Moderately tracked stock with growing coverage and increasing market attention.

(3 Stars) 10–19 analysts: Moderately tracked stock with growing coverage and increasing market attention.

![]() (2 Stars) 5–9 analysts: Limited analyst coverage; niche firm with less easily available research.

(2 Stars) 5–9 analysts: Limited analyst coverage; niche firm with less easily available research.

![]() (1 Stars) Fewer than 5 analysts: Very few follow this stock; limited insights and higher uncertainty for early or higher-risk investing.

(1 Stars) Fewer than 5 analysts: Very few follow this stock; limited insights and higher uncertainty for early or higher-risk investing.

Broader analyst coverage usually means investors have access to more up-to-date research and trusted opinions. Stocks with minimal coverage can still present opportunities, but they often require deeper individual research and careful evaluation. Use Upturn’s star rating alongside its AI- powered advisories to balance fresh insights with clear signals when deciding what to buy, hold, or sell.

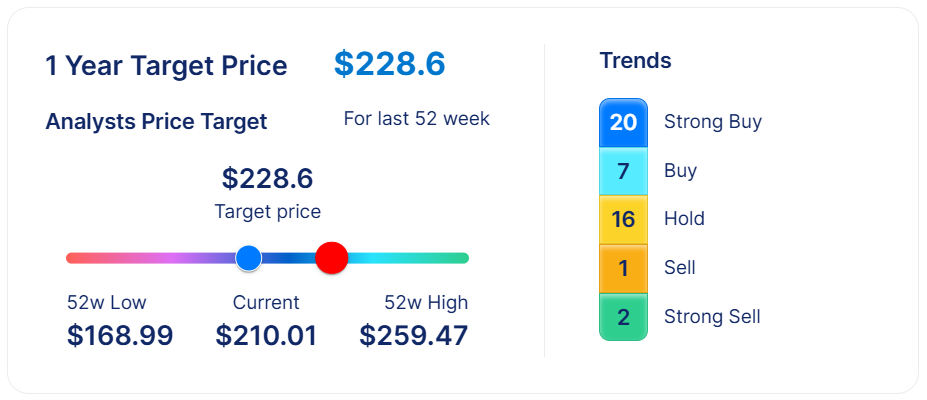

1-Year Price Target Chart

1-Year Price Target The 1-Year Price Target shows the average price analysts expect the stock to reach within the next 12 months, based on recent analyst reports and forecasts.

- Target Price ($228.6) - The average expected price in one year if analyst expectations hold true.

- Low ($168.99) - The stock’s lowest trading price in the last 52 weeks.

- High ($259.47) - The stock’s highest trading price in the last 52 weeks.

- Current ($210.01) - The stock’s current market price.

By comparing these, you can quickly see whether the stock has room to grow (if the target price is well above the current price) or if it may already be close to its fair value range.

Analyst Trends (Strong Buy to Strong Sell) On the right, you can see how many analysts recommend each action:

- Strong Buy - Analysts see strong upside, usually based on healthy fundamentals or growth signals.

- Buy - A positive outlook, but with more caution than Strong Buy.

- Hold - Analysts believe the stock is fairly valued at present.

- Sell / Strong Sell - Rare, but indicates some analysts expect the stock to underperform.

- 20 Strong Buy, 7 Buy, and 16 Hold - showing most analysts are optimistic.

- 1 Sell and 2 Strong Sell - very few negative recommendations.

Putting It All Together Combining these details gives you a fast, high-level snapshot:

- Is the stock trading below its 1-year target price?

- Where is the current price compared to the lowest and highest price seen in the last year?

- Do analysts mostly see upside, downside, or stability ahead?

If the target price is higher than the current price, the stock is closer to its 52-week high than its low, and most analysts rate it a Strong Buy, this suggests strong market interest and a positive outlook - but always remember: it’s a forecast, not a guarantee.

Use this as a starting point for deeper research alongside other fundamentals and Upturn’s AI-powered advisories.

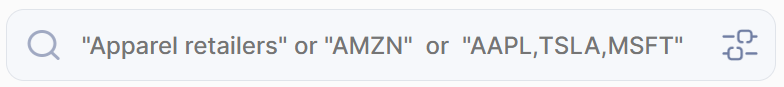

From Search to Success: Search powered by AI

Upturn simplifies and enhances your investment journey with robust search functionalities and personalized tools.

Efficient Search Capabilities Effortlessly locate stocks and ETFs by entering their names or symbols into the search bar. For batch searches, input multiple symbols separated by commas (e.g., "AAPL,TSLA,AMZN,MSFT") to view collective advisories. Moreover, Upturn's AI-driven natural language processing allows searches based on themes or sectors, such as "Apparel retailers", "CPU manufacturers", "Lithium companies" or "ETFs on cleantech" delivering relevant results tailored to your interests.

Interactive Stock and ETF Exploration Clicking on any stock or ETF card reveals detailed information and performance charts. Utilize the "Add to List" feature to seamlessly incorporate assets into your personalized "Watchlist" or any "Robo-Portfolio," facilitating organized tracking and management of your investments.

Customizable Robo-Portfolios Upturn empowers you to create Robo-Portfolios from search results, enabling the construction of diversified portfolios aligned with your investment strategies. This feature supports both instant and customized portfolio creation, allowing for tailored investment approaches.

Experience a streamlined and intelligent investment process with Upturn.io, designed to cater to both novice and seasoned investors.

Smarter Investment Discovery with Upturn Filters

Powerful Search & Filtering Upturn enhances your investment research with advanced filtering options, allowing you to tailor searches for stocks and ETFs based on specific criteria. Whether you're looking for high-performing assets, market trends, or personalized investment opportunities, Upturn makes it simple and effective.

Personalized Investment Filters Easily refine your search by filtering stocks/ETFs with a "BUY" advisory or an Upturn 4+ Star rating. Additional filters allow you to sort by asset type (stocks or ETFs), market capitalization (e.g., large-cap), and Upturn advisory performance (historical accuracy of recommendations). You can also assess Upturn stock performance (how stocks reacted to Upturn's BUY and SELL signals), company size, daily trade volume, or whether an asset is currently labeled as a Top Performer or Top Pick.

Risk Awareness & Enhanced Insights To help investors assess risk effectively, Upturn incorporates risk annotations, categorizing filter selection as "low-risk" "medium-risk" or "high-risk" These labels consider factors like company size, trade volume, and historical advisory performance, providing an extra layer of transparency for decision-making.

Confident, Data-Driven Investing By leveraging Upturn's robust search and filtering capabilities, investors can efficiently discover, analyze, and act on investment opportunities that align with their financial goals and risk preferences.

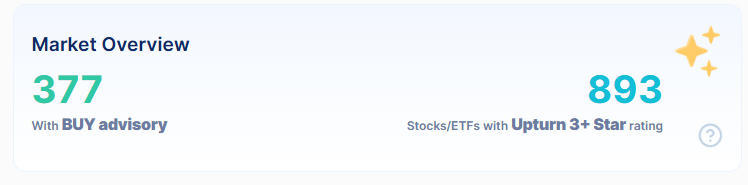

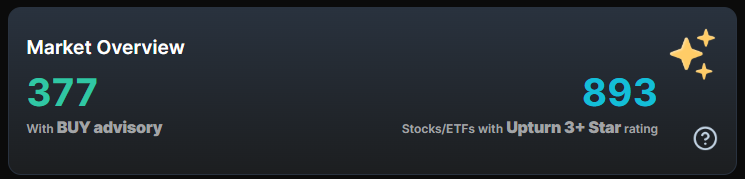

Upturn Market Overview

Upturn's dashboard features a Market Overview card displaying the total number of Upturn 3+ Star-rated, Large-cap or Mid-cap stocks, along with those currently holding a BUY recommendation.

Investors can easily access filtered lists by clicking on these numbers, streamlining the process of identifying top-rated investment opportunities.

Descriptions of terms and metrics

The following section describes performance metrics and terms used

Note: Please see the Disclosures for Performance Metrics and Simulations for assumptions and considerations used in the simulation (hypothetical) returns and ratios.

Upturn Star Rating For Stocks and ETFs

5 Star Rating ![]()

![]() Outstanding - These Stocks/ETFs, based on Upturn Advisory, have historically outperformed the market, making them a top-tier choice for investors.

Outstanding - These Stocks/ETFs, based on Upturn Advisory, have historically outperformed the market, making them a top-tier choice for investors.

4 Star Rating ![]()

![]() Above Average - These Stocks/ETFs, based on Upturn Advisory, frequently surpass the market, reflecting largely reliable performance.

Above Average - These Stocks/ETFs, based on Upturn Advisory, frequently surpass the market, reflecting largely reliable performance.

3 Star Rating ![]()

![]() Moderate - These Stocks/ETFs, based on Upturn Advisory, typically align with the market average, offering steady but unremarkable returns.

Moderate - These Stocks/ETFs, based on Upturn Advisory, typically align with the market average, offering steady but unremarkable returns.

2 Star Rating ![]()

![]() Below Average - These Stocks/ETFs, based on Upturn Advisory, often underperform the market, warranting careful consideration before investing.

Below Average - These Stocks/ETFs, based on Upturn Advisory, often underperform the market, warranting careful consideration before investing.

1 Star Rating ![]()

![]() Not Recommended - These Stocks/ETFs, based on Upturn Advisory, consistently fall short of market performance, signaling caution before investing.

Not Recommended - These Stocks/ETFs, based on Upturn Advisory, consistently fall short of market performance, signaling caution before investing.

BUY Advisory (strong/regular/weak)

“BUY” advisory indicates the stock or ETF could be in an Upturn or upwards trending based on the AI/ML and Quantitative analysis. The “BUY” advisory is often annotated such as

- STRONG BUY

- REGULAR BUY

- WEAK BUY

All of these indicate a “buy” advisory based on technical analysis (AI/ML and Quantitative) but shows different degree of trends or factors which are positively influencing the “buy” advisory. For instance, “strong buy” has more trends or factors in the algorithm showing positive “buy” trend compared to “regular buy” and has much lower trends or factors suggesting “buy” for “weak buy”.

Also, if the Stock or ETF has Upturn star rating of 1 or 2, the “BUY” advisory is shown as “Consider higher Upturn Star rating”

PASS Advisory

A “pass” advisory indicates that there are no upturns or upward trends seen in the stock or ETF to recommend a “buy” for now and hence the stock or ETF could be passed for now.

SELL Advisory

When the technical analysis (AI/ML and Quantitative) doesn’t show any continued positive trends or factors to further influence the upward movement of the Stock or the ETF, the BUY advisory is updated to a SELL advisory.

Stocks and Stocks Chart (Simulated)

Following are terms and its definitions and assumptions used when showing the Company’s historic recommendations.

Note: Please see the Disclosures for Performance Metrics and Simulations for assumptions and considerations used in the simulation (hypothetical) returns and ratios.

Historic Profits

This is simulated compounded returns expressed in percentage Compounded means, in the simulation, the assumption is, the user gained or lost x% returns on its initial principal invested, that entire principal plus (or minus) the returns was reinvested in the next set of recommendations. Returns can be negative or positive. Historic Profits also include Unrealized profits which is described below.

Unrealized gains or profits, also known as "paper profits," represent the increase in value of assets that have not yet been sold. In the context of Upturn.io, these gains occur when a "BUY" recommendation has been issued for a stock or ETF, but no corresponding "SELL" recommendation has been made. Consequently, the asset remains in a "BUY" status, and any potential profits or losses are considered unrealized until a "SELL" recommendation is executed. In simulation scenarios, this means the asset is held without being sold, so the returns are not yet realized.

The compounded profits takes into consideration the simulation of having reinvested the principal and returns for all the recommendations of the Company for the stock since the simulation start date, which is over 2.5 years. The date was chosen to ensure that the simulation data spans more than 2 years and is measured as a percentage. The profits can be positive in case of a profit or could be negative in case of a loss. (The disclosures below provides details about the assumptions while calculating returns in a simulated transaction) [1]

Upturn Advisory Performance

This is a measure of how well Upturn advisory performed for this stock based on simulation. That is, what percentage of times when Upturn Advisory recommended a “BUY” and a corresponding “SELL” did the simulation show a profit.

Stock Returns Performance

This is a measure of how well the stock returns performed with respect to Upturn advisory for the stock based on simulation. That is, what is the cumulative returns for the stock in terms of percentage when Upturn Advisory recommended a “BUY” and a corresponding “SELL”.

SELL Advisory (Profit)

This is for a “SELL” recommendation in the simulation of Upturn recommendations starting over 2.5 years, for the stock which ended in a profit (i.e., positive return).

Note: Refer to Disclosures for Performance Metrics and Simulations which goes into assumptions made in simulation.

SELL Advisory (Loss)

This is for a “SELL” recommendation in the simulation of the Company’s recommendations starting over 2.5 years, for the stock which ended in a loss or negative returns.

Note: Refer to Disclosures for Performance Metrics and Simulations which goes into assumptions made in simulation

Robo-Portfolio performance simulation charts and ratios

Upturn.io's Robo-Portfolio simulations allocate equal weight to each stock, calculating daily returns over approximately the past 2.5 years. The simulations track performance as if executing "BUY" or "SELL" actions based on the platform's advisories. Please review the disclosures for assumptions and considerations regarding simulated or hypothetical returns and ratios. This section details the various performance metrics and terms utilized.

Note: Please read the Disclosures for Performance Metrics and Simulations

Upturn uses Python Empyrical library (or its close implementation)

https://github.com/quantopian/empyrical for the calculation of key ratios and performance metrics of the Portfolio simulation.

Cumulative Returns

This is simulated compounded returns of the Robo-portfolio expressed in percentage. When this is shown in charts, the Robo-Portfolio starts with a principal value of 1 (normalized value for charts) and simulates how it performed if executed "BUY" and "SELL" based on Upturn Advisory on each of the stocks (with the assumptions as discussed in Disclosures for Performance Metrics and Simulations) over the last 2.5 years. The charts also compare these cumulative returns with SPY (S&P SPDR 500 ETF). You can zoom into the performance starting from 1 year ago or 3 months ago

Annualized Returns

This is the mean annual growth rate of returns of the equally weighted Robo Portfolio as per simulation

Sharpe Ratio

This is the risk adjusted return of the equally weighted Robo Portfolio as per simulation

Sortino Ratio

This is the risk adjusted return of the equally weighted Robo Portfolio as per simulation, but it only considers the downside volatility (negative returns) as risk

Annual Volatility

This is a measure of risk in annualized term. It indicates how far the prices could swing in either direction from the average value

Alpha

This is the measure of the equally weighted simulated Robo Portfolio’s ability to beat the market or how does it compares to the market (here SPY is used to indicate market)

Beta

Alpha is typically measured along with beta which measures the overall market risk of the simulated Robo Portfolio (here SPY is used to indicate market)

Max Drawdown

This is the maximum observed loss from a peak to a trough of the equally weighted Robo Portfolio, before a new peak is attained.

Learn more about

- Upturn Insights: Decoding Market Moves

- Understanding Upturn's Stock/ETF Advisory Chart

- Upturn Star Rating for Stocks and ETFs

- Analyzing Revenue: Products, Geography and Growth

- Watchlist, Robo-Portfolios and ETF Zone

- Instant and Custom Robo Portfolios

- Robo Portfolio Performance Metrics

- Upturn Star Rating for Robo-Portfolios

- Upturn’s Analyst Coverage Star Rating

- From Search to Success: Search powered by AI

- Smarter Investment Discovery with Upturn Filters

- Upturn Market Overview

- Descriptions of terms and metrics

Note: This website is maintained by Upturn Corporation, which is an investment adviser registered with the U.S. Securities and Exchange Commission. Such registration does not imply a certain level of skill or training. Investing in securities has risks. Past performance is no guarantee of future returns. No assurance is provided as to any particular investment return, and you may lose money using our services. You are strongly advised to consult appropriate counsel before making any investments in companies you learn about through our services. You should obtain appropriate legal, tax, investment, accounting, and other advice that takes into account your investment portfolio and overall financial situation. You are solely responsible for conducting due diligence on a potential investment. We do not affect trades for you. You will select your own broker through which to transact. Investments are not FDIC insured, they are not guaranteed, and they may lose value. Please see the Privacy Policy, Terms of Use, and Disclosure for more information.

Home

Home